Tax Stamps

Introduction to the tax stamp system

To ensure that manufacturers pay the VAT due on each product they sell, it is necessary to know how many of those products have been produced by the manufacturers. By supplying manufacturers with tax-stamps that must be applied to all products sold, governments can monitor how many products are sold by each manufacturer and so ensure that the VAT is paid on those products.

The principle advantages of the tax-stamp system are as follows:

It is simple to administer – it is immediately apparent if a product does not have a tax-stamp

It is secure – tax-stamps can include security measures making them impossible to counterfeit.

It is cost-effective – the simple administration and low cost of each tax-stamp makes tax-stamps the most cost-effective way of increasing tax revenue.

Tax-stamp overview

Tax-stamps have multiple layers of security including an encrypted 2D-barcode which provides information such as the production date of the tax-stamp and its serial number.

The tax-stamps usually have a size of about 15mm square so that they are small enough to fit on items such as bottle caps but large enough to contain the 2D-barcode and other data.

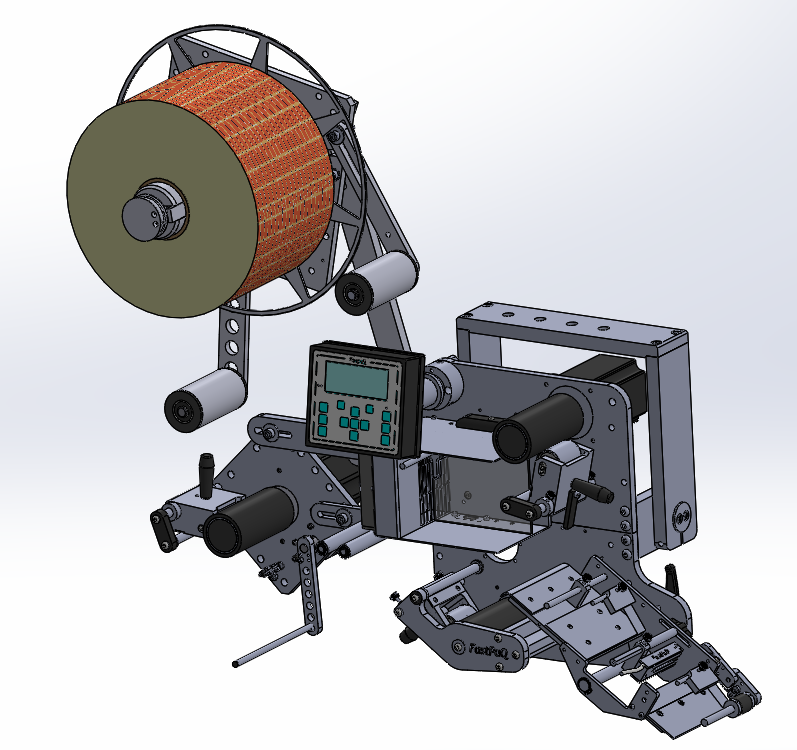

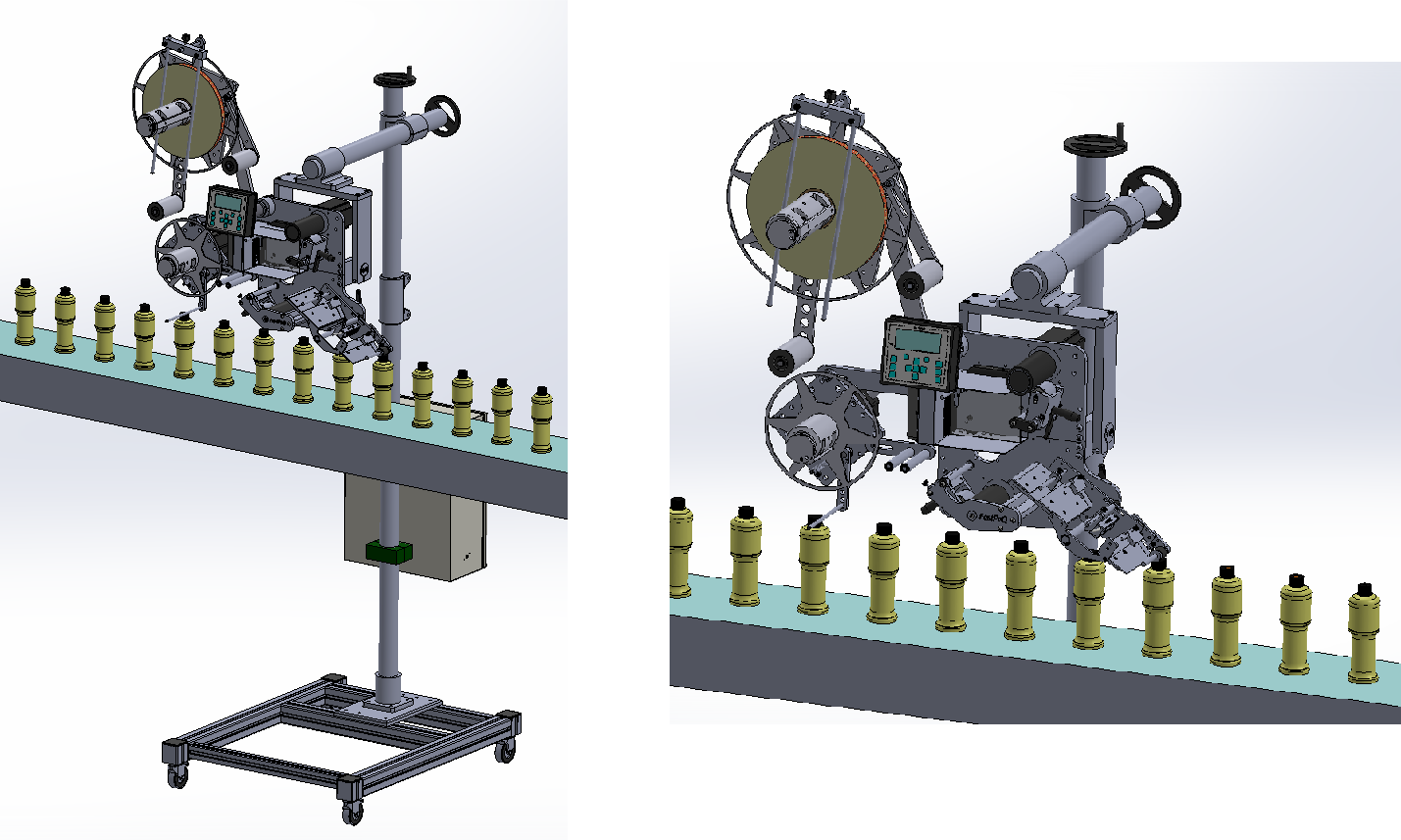

The tax-stamps are typically of paper construction and supplied in rolls. The tax-stamps can be applied to bottles and other products with special tax-stamp applicators that can be easily installed on production lines.

Tax-stamp applicators

Applicators that have been verified to be able to apply the tax-stamps at very high speeds and with good accuracy are provided at a heavily discounted price to support manufacturers who need to apply the tax-stamps.

Security overview

Verification of the 2D-barcode on each tax-stamp is carried out with special hand-held barcode scanners provided to government officials and also with regular mobiles phones via an internet connection. The hand-held barcode scanners allow faster verification of large numbers of tax stamps.

The 2D-barcodes have two levels of security. The first level allows hand-held scanners to verify the tax-stamps without any internet connection. The second level is available with an internet connection and works by verifying the encrypted barcode data against a secure database.

Guilloche background

The tax-stamps have a complex background pattern known as a guilloche. This is almost impossible to copy accurately and is designed so that automatic copying techniques create noticeable anomalies in the background pattern.

Alpha-numeric string

The tax-stamps have a string of human-readable alpha-numeric characters printed on them. The characters can be verified as valid using a hand-held scanner or mobile phone.

Microtext

The tax-stamps have microtext that is only readable using a magnifying device. The text is so small it is difficult to reproduce accurately.

Hidden security

The tax-stamps contain hidden security features that can be verified by FastPaQ. Since the features are hidden they cannot be replicated by potential counterfeiters.

Optional additional security features

Laser pen checking

The tax-stamps can include special marks that glow a particular colour when exposed to light from laser pens provided to government officials.

UV light checking

The tax-stamps can include hidden text that is only visible when exposed to UV light. Devices known as UV black-lights can be provided to government officials.

Security slits

The tax stamps can have a pattern of security slits causing them to tear if there is an attempt to remove them from a product.

2D-barcode in detail

The 2D-barcode data includes as a minimum the tax-stamp production date, batch number and a long serial number. The barcodes include error correction so that wrinkles or scratches on the tax-stamp do not prevent the barcode being read. In the case of very wrinkled or damaged tax-stamps a human-readable string of alpha-numeric characters on the tax-stamp allows the tax-stamp to be verified as genuine.

Verification of the barcodes is possible with hand-held barcode scanners provided to government officials and also with mobiles phones.

A database program checks for barcodes that have already been scanned and provides the time and date of previous scans.

The data contained in the 2D-barcode can include product type, product manufacturer and so on if required.

Bobbin wound tax-stamp rolls

Very large tax-stamp rolls can be manufactured with over a quarter of a million tax-stamps on a single roll. These can be be provided to those manufacturers that prefer this format.

The FastPaQ applicators that are used to apply the tax-stamps can optionally apply either type of tax-stamp roll. The bobbin wound rolls allow manufacturers to apply tax-stamps to their products for many hours without having to stop their production lines to change the tax-stamp roll.